Rebuilding our Global Economy with Digital Capital

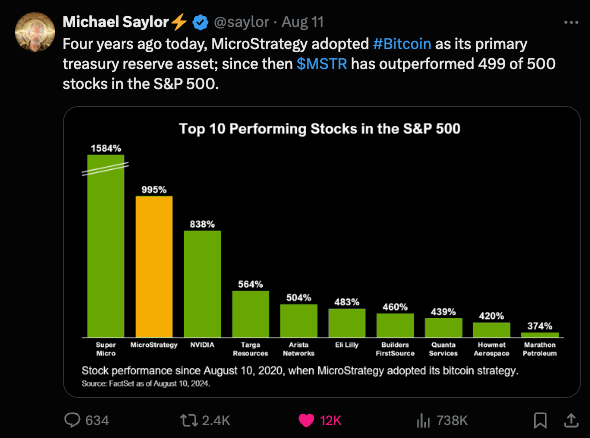

August 2020 marks a pivotal moment in the history of Bitcoin and my personal Bitcoin journey. That month, MicroStrategy made headlines by adopting Bitcoin as its primary treasury reserve asset. Four years later, Michael Saylor has emerged as the foremost storyteller of the Bitcoin narrative, with over 100% skin in the game. His deep understanding and unique perspective on Bitcoin were showcased at this year’s Bitcoin Conference in Nashville. I am meticulously documenting his presentation, titled ‘The Bitcoin Revolution,’ to capture the insights he shared.

The Bitcoin Revolution: Bridging the Gap Between 20th and 21st Century Finance

During my time as an intern at Toyota, one lesson that left a lasting impression on me was the Toyota Business Practice (TBP). This method, designed to solve problems efficiently, involves eight crucial steps. You can dive into the details of this practice in this blog post, but I want to highlight one particular step that’s relevant to the topic at hand—step 2: Break Down the Problem.

Breaking down a problem involves assessing the current situation, identifying the ideal scenario, and recognizing the gap between the two as the problem itself. This framework is invaluable when we analyze our financial systems today. Our legacy financial world is built on ideas and technologies from the 20th century, a time when the concept of 24/7 accessibility was far from reality.

Consider this: Traditional financial markets operate only 40 hours a week, closing on weekends and public holidays. In the 21st century, we’re accustomed to on-demand access in nearly every aspect of our lives. From streaming services to online shopping, we expect instant gratification. Cryptocurrency markets have adapted to this reality, remaining open 24/7, 365 days a year. Ideally, financial markets should function the same way, but that’s not our current reality.

Take, for example, my desire to purchase MSTR stock on a Saturday morning. Although I can place the order, it doesn’t get filled until Tuesday. Sometimes, discrepancies arise in after-hours market prices. In stark contrast, I’m able to purchase Bitcoin every hour, seamlessly, through recurring transactions. This discrepancy in market operation times highlights the gap between the current financial system and what could be possible.

Michael Saylor, in his presentation “The Bitcoin Revolution,” eloquently discusses this very gap. He argues that our financial markets are slow, expensive, and burdened with high transaction and management fees. Consider my experience with my Canadian bank, where I’m charged $11 a month simply because I don’t maintain a $5,000 CAD balance in my checking account. In contrast, I store Bitcoin in cold storage without any fees. Additionally, transferring money between countries, such as from Canada to the USA, is a time-consuming and often frustrating process. Just two days ago, I initiated a transaction, and the money has yet to be delivered. If the world operated on the Bitcoin Standard, such transactions would be completed from one wallet to another within seconds.

To thrive in the 21st century, it’s essential for individuals and institutions to adopt new ideas and technologies. As Michael Saylor highlights, just as society embraced innovations like steel, antibiotics, airplanes, and aluminum, we must now embrace Bitcoin and other advancements that reflect the needs of our time.

This is the gap we must address—a gap that Bitcoin is uniquely positioned to fill. The future of finance is here; it’s time we fully step into it.

Bitcoin’s Place in Global Wealth: A Small Blip with Big Potential

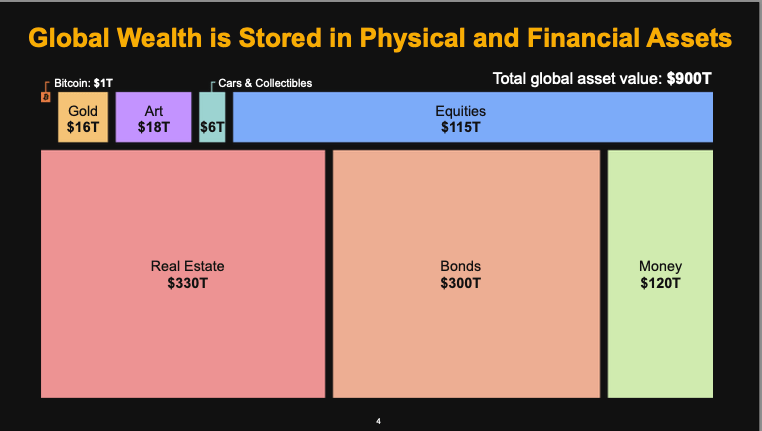

Michael presents a compelling chart of global wealth, illustrating the total wealth accumulated by humanity up to this point. He categorizes this wealth into two main asset classes: Physical and Financial Assets. The total value of global wealth stands at a staggering $900 trillion. Of this, physical assets—such as gold, art, collectibles, and real estate—account for $370 trillion, while financial assets, including equities, bonds, and money, amount to $535 trillion.

If you look closely at the slide, you’ll notice a small orange blip representing Bitcoin, currently valued at around $1 trillion. In the context of global wealth, Bitcoin’s share is a mere 0.1%. This 15-year-old asset is still in its infancy, barely making a dent in the grand scheme of global wealth.

So, if you’re not yet deeply familiar with Bitcoin, don’t worry—you’re still early in the game. There’s a vast landscape of potential ahead.

Michael encourages us to view the chart from a different perspective. Instead of simply dividing global wealth into physical and financial assets, he suggests we consider these assets in terms of their function: store of value versus utility. For those unfamiliar with the concept of a store of value, it refers to the human desire to preserve wealth over time. As government-issued money inflates and loses value, people seek alternative stores of value—such as real estate, bonds, stocks, art, and collectibles.

On the other hand, utility assets are those we use in our daily lives, like the car we drive, the house we live in, or the businesses we operate. Michael proposes that the $900 trillion of global wealth can be evenly split: $450 trillion as a store of value and $450 trillion in utility.

Most of us buy a house to live in, but many also purchase property as an investment, simply because they have excess cash and need a place to store it. The ultra-wealthy often buy properties in cities like New York, London, or Toronto—not to rent them out, but purely as a store of value. This contrasts with the majority who use their homes for practical utility.

When you recognize how people use inefficient methods to store value or preserve long-term capital, the need for change becomes apparent. Michael envisions a $450 trillion revolution in how we store value.

This inefficiency impacts everyone. The wealthy drive up prices by buying scarce properties purely as a store of value, making it harder for ordinary people to afford homes. The global economy suffers because we rely on imperfect assets and flawed systems to preserve our capital. It’s clear that our capital preservation systems need a complete overhaul.

How do we engineer a better economic system?

Michael proposes that we reframe our understanding of reality using a perspective famously suggested by Nikola Tesla: “If you wish to understand the universe, think in terms of energy, frequency, and vibration.”

Matter is fundamentally energy, and energy cannot be created or destroyed—it only transforms from one form to another. Frequency, in this context, refers to how long it takes for energy to complete one cycle, encompassing concepts of time, duration, and the lifespan of change. The number of cycles energy undergoes within a given timeframe defines its frequency. Higher energy correlates with higher frequency, meaning more cycles occur in a shorter time, resulting in a greater amplitude and shorter wavelength. Frequency, then, is tied to time, while vibration relates to motion. Vibration describes the back-and-forth movement, and a higher frequency indicates faster oscillation or quicker movement from one point to another.

By grasping these three interconnected concepts—energy, frequency, and vibration—you gain a profound understanding of the universe from a new perspective. Michael is applying this understanding to our economic systems.

In an economic system, money, capital, and wealth can be viewed as forms of energy. When we earn a salary, a portion of it is spent on necessities like food, which in turn provides us with physical energy. Thus, from an economic perspective, money or wealth can be seen as accumulated energy that we can harness to fulfill our desires and goals.

Frequency, in this context, relates to time—specifically, how long it will take to achieve something. In economics, we often evaluate things based on productivity, sustainability, and utility. Understanding the useful life of an asset falls under the concept of frequency. It’s about asking: How much energy (or capital) do I need to invest to maintain the asset in its current pristine condition? What are the annual costs required to preserve its value over time? How much must I spend to prevent depreciation or decay?

The chart above illustrates the useful life of financial assets by showing how long it takes for them to lose 99.9% of their value. For instance, the Argentine Peso takes just 2 years, the Turkish Lira 3 years, the US Dollar 14 years, Hedge Funds 25 years, US Treasury Bonds 30 years, and Mutual Funds 100 years. This rapid devaluation is primarily driven by currency debasement by central banks, influenced by regulatory and political factors.

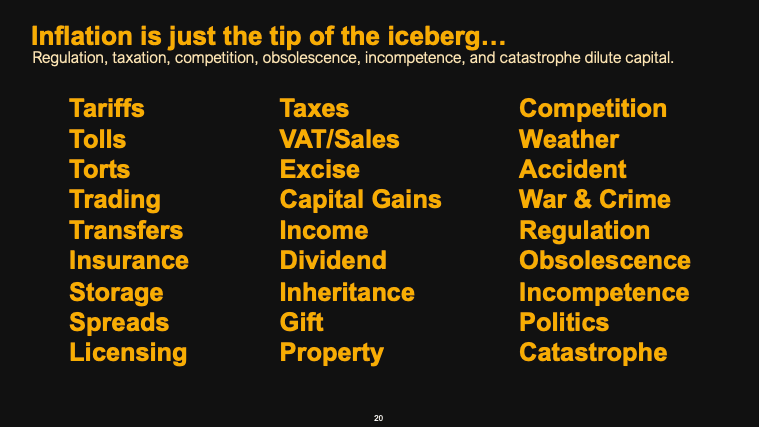

Government coercion isn’t limited to inflation; there are numerous other factors that can erode the value of capital. These include tariffs, natural disasters, war and crime, various forms of taxation, licensing requirements, insurance mandates, and more. The chart below shows the elements that can contribute to the devaluation of assets in different ways.

The rapid devaluation of financial assets drives people towards a high time preference mindset, where long-term thinking is overshadowed by the desire for instant gratification. This high time preference manifests in behaviors like job-hopping, consuming fast food, seeking quick education through 15-second TikTok videos, and engaging in superficial relationships—activities that require minimal time investment.

In contrast, meaningful pursuits like regular exercise, marriage, and healthy eating habits demand time and dedication, which in turn necessitate a reliable store of value. When money loses its value quickly, people become more money-centered because they’re constantly trying to keep up with rising costs. As a result, truly valuable aspects of life—such as health, art, family, and spirituality—are neglected and devalued.

This creates a deep sense of frustration, especially among young people who have abundant energy but lack a stable asset to invest it in. Their energy is dissipated on distractions and trivial pursuits instead of being focused on meaningful and fulfilling activities.

People turn to scarce physical assets to preserve their capital because governments can’t simply print more of them, and in democratic, capitalist countries, they can’t impose price controls on these assets. While taxes can be increased, the government can’t regulate the price of collectible items. This is why the ultra-wealthy often invest in collectible art, gold, beachfront properties, or other scarce physical assets like vintage cars and rare paintings.

However, these assets come with significant risks. They require substantial emotional investment to protect them from theft, damage, or confiscation. This, in turn, fuels black markets and smuggling. For example, during times of hyperinflation in developing countries, there has been a surge in cars being stolen from developed countries and smuggled into these unstable economies. People in these hyperinflated regions avoid holding cash, opting instead to buy physical assets that can’t be devalued by an easily increased supply.

Physical assets are also subject to entropy—they require ongoing maintenance to retain their value. A collectible car, for example, comes with costs like maintenance, insurance, fuel, and other hidden expenses that can add up over time. Michael illustrates this with a chart showing the useful life of various physical assets. At the top is the Crown Estate, which benefits from tax exemptions and has a long useful life, while at the bottom is a Ferrari, with a useful life of just 5 years.

In a country like Argentina, where the peso has a useful life of only 2 years due to rapid devaluation, buying a Ferrari might seem like a better option than holding onto cash, as the car retains value for a longer period. This dynamic helps explain why cars are often stolen from countries with lower inflation rates and smuggled into those with higher inflation—people are seeking more stable stores of value in a volatile economic environment.

Consider the common example of a rental property purchased as a store of value. While it may seem like a solid investment, owners often overlook the numerous challenges beyond just maintaining the property. They must also pay property taxes, secure home insurance, manage rent control regulations, navigate city politics, deal with tenant behavior, and address issues like water leaks from floods or weather damage. These factors, often underestimated, can significantly erode the value of physical capital over time.

Financial assets can be complex, sophisticated, and difficult to fully grasp, which is why most people choose to store their wealth in cash, real estate, and gold. This reflects the conventional wisdom that favors preserving capital in something tangible. People generally feel more secure investing in physical assets like real estate, land, and gold rather than in stocks and bonds.

Bitcoin: A digital refuge from the Entropy of Physical and Financial Assets

Michael Saylor is a MIT graduate double majored in aeronautical & astronautical engineering and history of science.

Michael shares his reality in public through the lens of engineering, grounding his beliefs in the laws of physics, particularly the three laws of thermodynamics. As a Mechanical Engineer who studied thermodynamics in two courses and heat transfer in another, I may not be as brilliant as Michael, but I’ll do my best to explain what he meant in the slide below in simpler terms.

The first law of thermodynamics, known as the law of conservation of energy, states that energy cannot be created or destroyed; it only transforms from one form to another. This law is absolute—we cannot generate new energy out of nothing. Instead, we must work with the energy already available to us. While we might find ways to manipulate economic and political systems, like controlling interest rates through centralized authorities, printing money(energy) out of thin air, but the physical world governed by the laws of physics is immutable. No one can alter constants like the speed of light or the force of gravity.

The second law of thermodynamics tells us that we can’t break even. In simple terms, it states that heat naturally flows from a hotter body to a colder one, releasing energy in the process. However, not all the energy from the hotter body will transfer to the colder one; some will dissipate as waste heat into the environment. This means that in the physical world, we can never achieve a perfect transfer of energy—there will always be some loss.

The third law of thermodynamics asserts that we cannot reach absolute states, such as absolute zero temperature (0 Kelvin). This means we can’t escape the ‘game’ by achieving perfect, ideal conditions. We can strive to improve and play the game more efficiently, but perfection is unattainable. Even when we believe we aren’t participating, such as when we’re sleeping, our bodies are still active—our hearts are pumping blood, and our lungs are taking in oxygen. In other words, you can’t opt out of the game.

Imagine a world where everything is exactly as it’s described, no room for error or interpretation. While this isn’t how our physical world works, it might be possible in the digital realm. When you write the number “1,” it’s just 1, absolute and unchanging. But when you measure something as “1 inch,” it’s never truly 1 inch; it might be a hair less or more. Money works the same way; $1 isn’t just $1 because its value shifts with the total amount of money in circulation. Today, $1 might represent a tiny fraction of the total dollars out there, but tomorrow, with more dollars printed, it represents an even smaller slice.

In our tangible world, information and measurements always come with a bit of uncertainty, a margin of error. However, in the digital world, information can be absolute. If you have a digital file, it can be copied and shared infinitely, which poses a problem – how do you keep something unique when it can be replicated so easily? If we could solve this issue, we might achieve what’s called “absolute scarcity” in the digital space, where a digital item could be as unique as a physical object, potentially revolutionizing how we think about digital ownership.

Imagine you have a treasure chest, but instead of gold or jewels, it’s filled with something that can’t be duplicated or worn down over time. This treasure is what we’re calling absolute scarcity. Here’s how it works in simpler terms:

- Value Over Time: Normally, when you store money or valuables, they can lose their worth over time. Think of how money in your pocket might buy less candy next year because of inflation, or how a car loses value as it gets older.

- No Battery Drain: In this new system, think of your wealth like a digital energy that never needs to be recharged or replaced. It doesn’t wear out or lose its value like batteries do in your gadgets.

- Entropy: In the real world, everything tends to break down or wear out over time. This is called entropy. But with absolute scarcity, your wealth doesn’t follow this rule. It stays the same, forever in time.

- Constant Denominator: Usually, the value of money goes down as more money is printed (the denominator, or the total amount of money, increases). But with absolute scarcity, the total amount of your wealth stays fixed. It’s like having a pie that never gets bigger or smaller, so each slice (your wealth) always represents the same portion of the pie.

- Breaking Even: In this system, you’re not losing value over time. You’re keeping what you have, without it diminishing. It’s like putting your money in a safe that not only keeps it safe but also ensures its value doesn’t decrease.

So, by storing your wealth in something with absolute scarcity, you’re essentially locking in its value. It’s like having a treasure that time can’t touch, where your wealth remains as valuable today as it will be in a thousand years, without any loss due to the natural decay or inflation.

You Could Win: Here’s where it gets interesting. With absolute scarcity, you could achieve a form of immortality for your wealth. What you earn and store in this system remains yours, untouchable by anyone else, even after you’re gone.

Celebrating Eternally: Imagine this, even after you pass away, you could still celebrate special occasions like Valentine’s Day. You could set up your wealth to send roses to your wife and daughter every year for the rest of their lives. Your love and care continue, undiminished by time, thanks to the enduring value of your stored wealth.

So, by storing your wealth in something with absolute scarcity, you’re not just preserving its value; you’re ensuring that what you’ve worked for in life can continue to make a difference long after you’re gone, offering a kind of legacy that transcends time itself.

In his presentation, as Michael advanced to the slide above, a wave of chills swept over me. This was it – the essence of renunciation, the pinnacle of power. There’s nothing more profound than this.

Satoshi Nakamoto stands as the modern avatar of this principle. He crafted Bitcoin under a veil of anonymity, ensuring its essence remained untainted by personal gain. By releasing it as an open protocol, he not only decentralized it but also set the stage for his ultimate act of renunciation. When Bitcoin came to life, Satoshi stepped back, leaving behind a legacy that thrives on its own merit, free from the shadow of its creator.

This is the epitome of power – to create and then let go, allowing the creation to stand on its own.

1. Immortal:

- Longevity: Bitcoin’s digital nature ensures that it can persist indefinitely as long as humans sustain the knowledge of electricity, computer, internet and the Bitcoin whitepaper. Unlike physical assets that can degrade or perish over time, Bitcoin is not subject to physical decay or deterioration. Once mined, a Bitcoin can theoretically last forever, unaffected by the passage of time.

- Global Adoption and Network: As long as there is global interest and participation in the Bitcoin network, its existence is secured. The decentralized nature of Bitcoin, with nodes spread across the globe, makes it resilient to single points of failure.

2. Immutable

- Blockchain Technology: Bitcoin transactions are recorded on a blockchain, a distributed ledger that is secured by cryptographic principles. Once a transaction is confirmed and added to the blockchain, it cannot be altered or reversed. This immutability ensures that the history of Bitcoin transactions is permanent and tamper-proof, making it a reliable and trustworthy store of value.

- Consensus Mechanism: Bitcoin’s proof-of-work consensus mechanism ensures that the network’s rules and the integrity of the blockchain are maintained. Any attempt to alter past transactions would require an immense amount of computational power, making such efforts practically impossible.

3. Immaterial

Universal Accessibility: Because Bitcoin is immaterial, it can be accessed, stored, and transferred by anyone with an internet connection, regardless of their location. This universality makes Bitcoin a truly global form of capital, transcending the limitations of traditional, tangible assets like real estate or gold.

Digital Nature: Bitcoin is entirely digital, existing only as data on the blockchain. It has no physical form, making it immune to the risks associated with physical assets, such as theft, damage, or geographic constraints. This immaterial nature also allows for the seamless transfer of value across borders, unimpeded by physical limitations.

The useful life of both financial and physical assets is inherently limited. The confusion and delusions many people face about where to store the value they’ve earned over their lifetime are causing widespread pain in society. This uncertainty fuels mass psychosis, reflecting the collective anxiety about their future.

However, the solution is already within reach. Many are now choosing to store their hard-earned money in Bitcoin. By converting their financial and physical assets into Bitcoin and securing it in self-custody cold storage, they are safeguarding their wealth for generations. With advancements in AI and digital custody, the value stored in Bitcoin could be passed down to your great-great-great-granddaughter.

Bitcoin represents a revolutionary leap in economics, transforming from physical metals to digital gold. The unfolding story of Bitcoin and how humanity embraces it will be fascinating to witness. Currently valued at $1.15 trillion, the question arises: how much of the world’s $900 trillion in wealth will flow into this digital asset in the coming years? Could Bitcoin reach or even surpass gold’s $16 trillion market cap within the next decade? If it does, we could see its price increase 16-fold, reaching around $900,000 USD per Bitcoin.

In today’s economic landscape, it’s crucial to understand not just how to create value, but also how value is traded and stored. The technologies we use to exchange and preserve value are equally important. Unfortunately, these critical concepts aren’t taught in schools or colleges. We’re often conditioned, consciously or subconsciously, to focus on making more money, but rarely do we learn how to sustain and grow it. This lack of financial literacy is evident in the numerous stories of NBA players and celebrities who earn massive amounts of money only to end up bankrupt. Take Mike Tyson, for example: despite his exceptional talent and the market’s generous rewards, he overlooked the importance of managing and preserving his wealth. Learning and applying these simple lessons can help avoid many costly mistakes.

Principles of trade:

Temporary for Permanent: At its core, you’re always exchanging your time for money. Time is fleeting, so it must be preserved in something enduring. You trade your time for currency, perhaps earning pesos, which can then be converted into something more stable like dollars. Those dollars might be invested in land, and ultimately, you could trade that land for Bitcoin, a form of value designed to be permanent.

Currency for Capital: One of the toughest challenges in today’s economy is saving money after meeting your needs. With current inflation rates, if you’re not in debt and managing to save, it’s unwise to hold onto currency. Instead, convert that currency into capital—assets that generate more currency. Capital includes things like your business, equipment, buildings, stocks, bonds, factories, technology, and rental properties. By wisely converting your fiat currency into capital that addresses society’s needs, you’ll be rewarded with ongoing financial returns.

Fragile for Resilient: Living in a mudhouse in rural Africa may be affordable, but it’s fragile, easily damaged by rain and floods, and requires constant upkeep. Trading it for a brick house is a smart move—brick houses are far more resilient, offering better protection against the elements and requiring less maintenance. While the initial cost is higher, this investment ensures long-term security and stability for your family, making it a wise choice that pays off over time.

Local for Global: Trading something local for something global is a smart move because it broadens your access to resources, markets, and opportunities. For example, a small business relying solely on local suppliers might face disruptions due to regional economic issues or limited product availability. By expanding to global suppliers, the business can access better quality materials, more competitive pricing, and a larger market. This diversification not only enhances resilience but also positions the business for greater growth and stability in the long run.

Physical for Digital: Trading a rental property, a physical commodity, for Bitcoin, a digital commodity, can be a smart decision for several reasons. First, Bitcoin offers a level of liquidity that physical real estate cannot match; it can be bought, sold, or transferred instantly across the globe without the need for intermediaries. Second, Bitcoin is a deflationary asset with a fixed supply, meaning its value is likely to appreciate over time, especially in an environment where fiat currencies are subject to inflation and potential devaluation. In contrast, rental properties require ongoing maintenance, management, and are subject to market fluctuations, taxes, and regulations that can erode their value and profitability. Additionally, Bitcoin provides a hedge against systemic risks in the traditional financial and real estate markets, allowing you to store and grow wealth in a decentralized manner that is resistant to seizure and censorship. For these reasons, converting a physical asset like a rental property into Bitcoin can be a strategic move to secure and potentially increase your financial future.

Security for Commodity: Trading security for a commodity like Bitcoin can be a strategic decision when considering long-term financial growth and stability. Unlike traditional assets that may offer a sense of security but are vulnerable to inflation, depreciation, and systemic risks, Bitcoin represents a scarce digital commodity with the potential for significant appreciation. By moving from conventional security to a deflationary asset, you position yourself to protect and potentially grow your wealth in a decentralized, censorship-resistant manner, offering a hedge against economic uncertainty.

Commodity for Scarcity: Trading a commodity for scarcity, such as exchanging real estate or other traditional assets for Bitcoin, can be a wise choice in a world where inflation erodes the value of abundant assets. Scarcity drives value, and Bitcoin, with its fixed supply, embodies this principle. Unlike commodities that can be subject to supply increases and market volatility, Bitcoin’s scarcity ensures that its value is more likely to appreciate over time, providing a robust store of wealth and a hedge against economic instability. By trading for scarcity, you secure a position in an asset designed to preserve and potentially increase in value over the long term.

Michael Saylor highlights some of the greatest trades in history in the upcoming slides. He points out that in a free world, people have often sought to move westward, where better opportunities and stronger property rights awaited them. For instance, Europeans migrated to America in search of greater security and prosperity. Reflecting on my own experience, my family moved from a village in India to Canada, and later, I secured a job in the USA, noticing similar benefits. Let’s explore the other trades Michael discusses.

The Dutch purchase of Manhattan for 60 guilders is one of history’s most remarkable trades. In 1626, the Dutch West India Company, representing the Dutch settlers, negotiated with the Native Americans to acquire Manhattan Island for a modest sum, roughly equivalent to 60 guilders, often estimated at around $24 at the time. Unbeknownst to the natives, they were selling what would become one of the most valuable pieces of real estate in the world. The Dutch, understanding the strategic importance of naval power and trade, quickly developed Manhattan into a bustling port, laying the foundation for what would eventually become New York City, the greatest port in the New World. This transaction illustrates how a keen understanding of the future potential and strategic value of assets can turn a seemingly simple trade into a monumental gain.

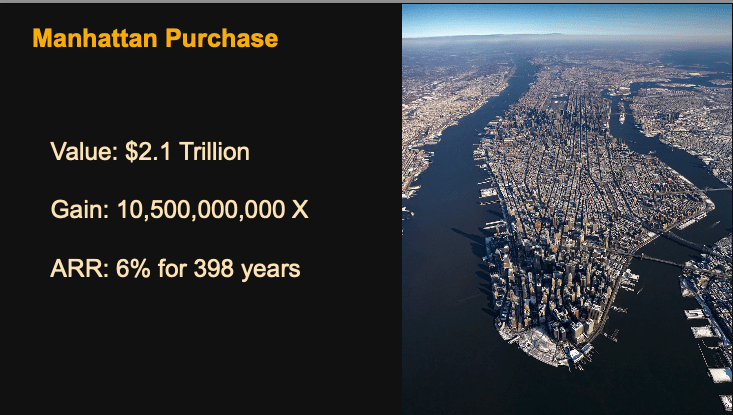

Manhattan, purchased by the Dutch has since transformed into one of the most valuable pieces of real estate in the world, now valued at approximately $2.1 trillion. This represents an astronomical gain of 10.5 billion times the original investment over 398 years. Calculating this impressive return reveals an average annual growth rate (APR) of around 6%. This incredible appreciation underscores the power of strategic long-term investment and foresight, where a modest initial outlay, coupled with an understanding of future potential, can lead to unimaginable wealth over centuries. Manhattan’s evolution from a sparsely populated island to a global financial hub illustrates the profound impact of compound growth over time.

In 1803, France, under Napoleon Bonaparte, sold the vast Louisiana Territory to the United States for $15 million, a decision driven by Napoleon’s need to fund his wars in Europe. While Napoleon focused on securing power in the Old World, Thomas Jefferson, then President of the United States, seized the opportunity to expand in the New World. This purchase doubled the size of the U.S., providing immense resources and strategic advantages that would fuel its growth into a continental power. The Louisiana Purchase exemplifies how differing priorities between the Old World and the New World led to a transformative trade in history.

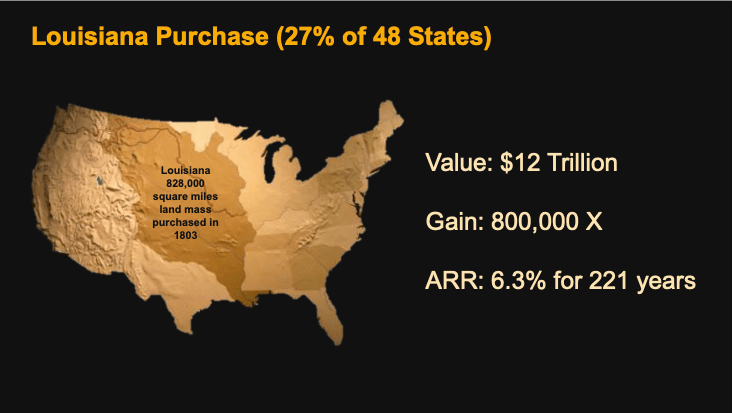

The Louisiana Purchase has seen its value skyrocket to an estimated $12 trillion today. This represents a staggering gain of 800,000 times the original investment over 221 years. The average annual growth rate (APR) for this land has been approximately 6.3%. This remarkable appreciation highlights the foresight of the purchase, which not only expanded the U.S. territory but also secured resources and strategic advantages that have compounded in value over time, making it one of the most significant real estate deals in history.

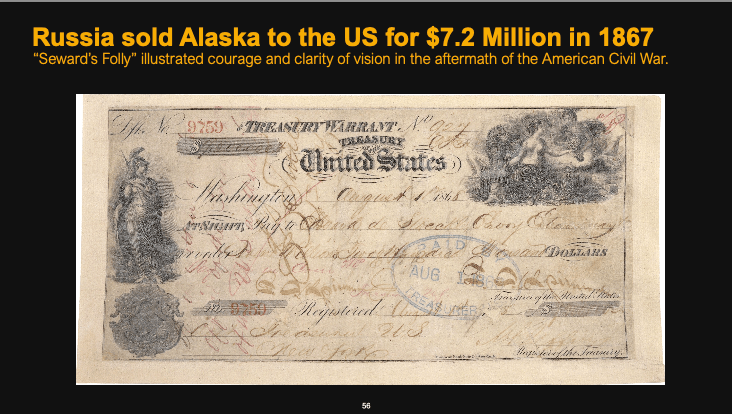

In 1867, Russia sold Alaska to the United States for $7.2 million, a transaction initially ridiculed as “Seward’s Folly” after Secretary of State William Seward, who orchestrated the deal. At the time, many Americans saw the purchase as a wasteful expenditure, especially in the aftermath of the Civil War when the nation was focused on reconstruction. However, this deal later proved to be a masterstroke of vision and courage, as Alaska’s vast natural resources, including gold, oil, and timber, contributed immensely to the wealth and strategic strength of the United States. Seward’s ability to look beyond immediate concerns and recognize the long-term value of Alaska exemplifies the importance of foresight in leadership and national growth.

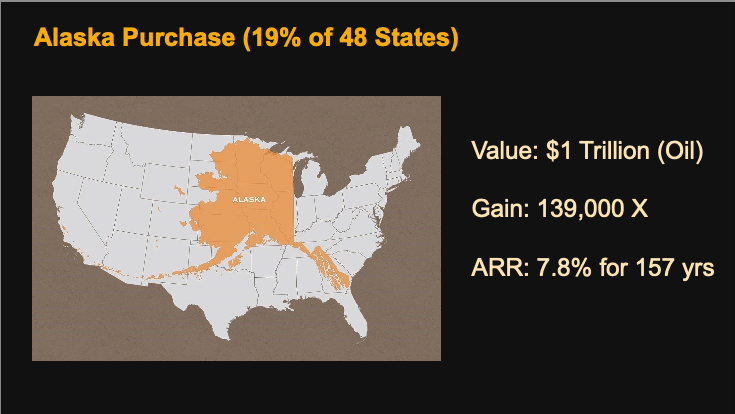

The Alaska Purchase, which added land equivalent to 19% of the contiguous 48 states, is now valued at $1 trillion. This represents an astonishing 139,000-fold increase over the original $7.2 million investment, achieving an average annual growth rate (APR) of 7.8% over 157 years. This dramatic appreciation underscores the far-reaching impact and strategic value of this once-criticized acquisition, which has proven to be one of the most lucrative investments in U.S. history.

Now, let’s return to the key question: What is Bitcoin truly worth? How will Bitcoin perform in the future? What will its value be? And how will wealth transition from physical and financial assets into digital assets like Bitcoin?

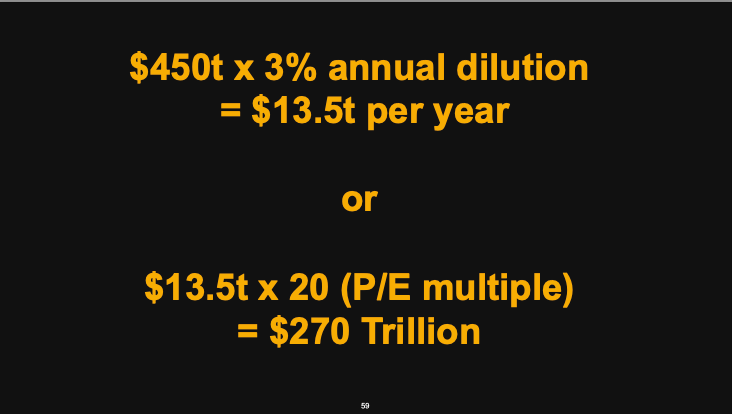

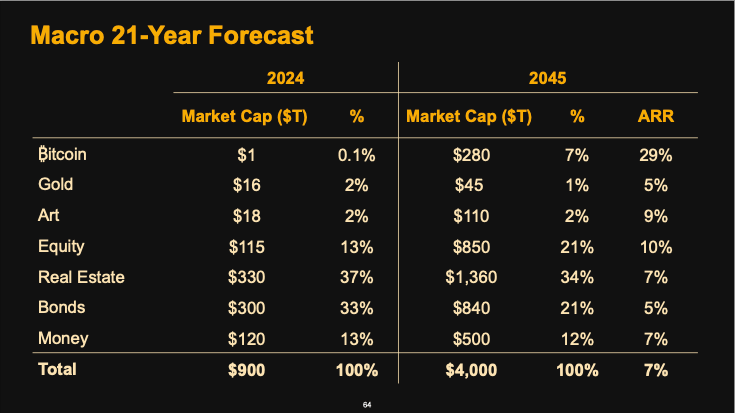

Michael Saylor projects that 3% of financial assets are being diluted annually, resulting in a yearly transfer of $13.5 trillion into alternative assets like Bitcoin. Over the next twenty years, this could lead to a total market value of Bitcoin reaching approximately $270 trillion by 2045.

The economic benefit of digital capital, including assets like Bitcoin, is projected to exceed $10 trillion annually. This shift towards digital assets streamlines global financial systems, reduces inefficiencies, and enhances transparency. By enabling faster, more secure transactions and providing broader access to financial markets, digital capital not only drives innovation but also democratizes wealth creation, ultimately fostering greater economic growth and stability on a global scale.

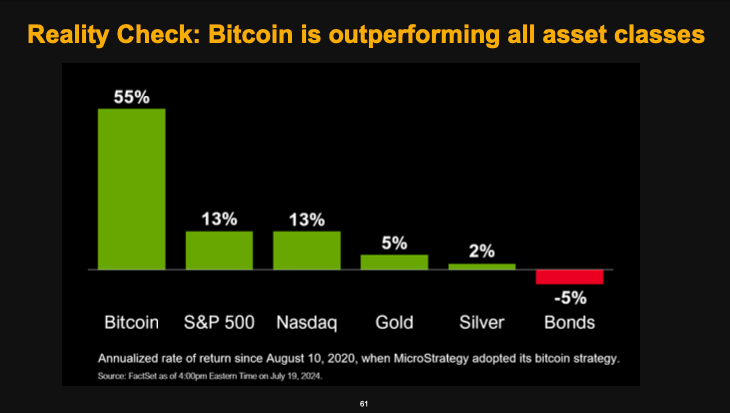

Since MicroStrategy adopted the Bitcoin standard on August 10, 2020, Bitcoin has consistently outperformed all other asset classes. The company’s strategic decision to convert significant portions of its treasury into Bitcoin has proven to be highly advantageous, as Bitcoin’s value has surged dramatically compared to traditional assets like stocks, bonds, and real estate. This move not only protected MicroStrategy’s capital from inflation but also significantly enhanced its overall financial position, demonstrating the power and potential of Bitcoin as a superior store of value in the modern economic landscape.

Michael presents a 21-year price forecast for Bitcoin, outlining three potential scenarios: Bear, Base, and Bull. In the Base case, Bitcoin’s price is projected to reach $13 million, while the Bear case estimates $3 million, and the Bull case envisions an astonishing $49 million. With Bitcoin currently priced at $60,000, the Base case suggests a potential 200x gain over the next 21 years.

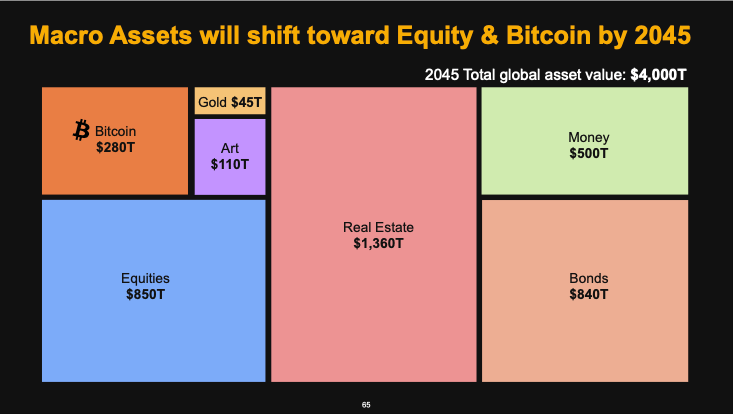

By 2045, the total global assets are projected to reach $4,000 trillion, with Bitcoin anticipated to account for $280 trillion of that value.

What does Bitcoin mean to you? Are you a salaried employee, a business owner, or perhaps leading a government or non-government institution? Maybe you’re part of a non-profit organization. No matter your role, understanding Bitcoin’s value and potential impact is crucial in today’s evolving financial landscape.

Every individual, regardless of their role, needs a Bitcoin strategy to navigate and capitalize on the future of digital finance.

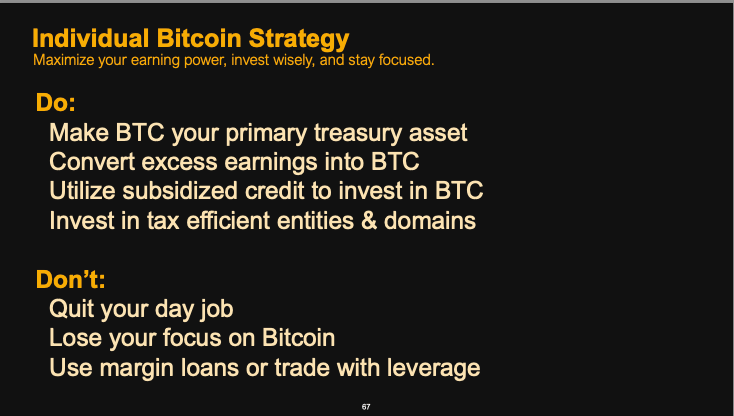

Everyone should develop a personal Bitcoin strategy tailored to their unique circumstances. The first step is to understand how Bitcoin works and consider making it your primary store of value. Focus on increasing your income, reducing expenses, and consistently converting surplus earnings into Bitcoin. You can also leverage subsidized credit by converting it into Bitcoin and repaying the debt over time. To optimize your financial strategy, invest in tax-efficient entities and jurisdictions. However, don’t make drastic changes like quitting your job suddenly; instead, steadily invest in Bitcoin and maintain your long-term focus. Given Bitcoin’s volatility, it’s crucial to avoid margin loans or leveraged trading, especially on unregulated exchanges where your assets could be at risk of liquidation.

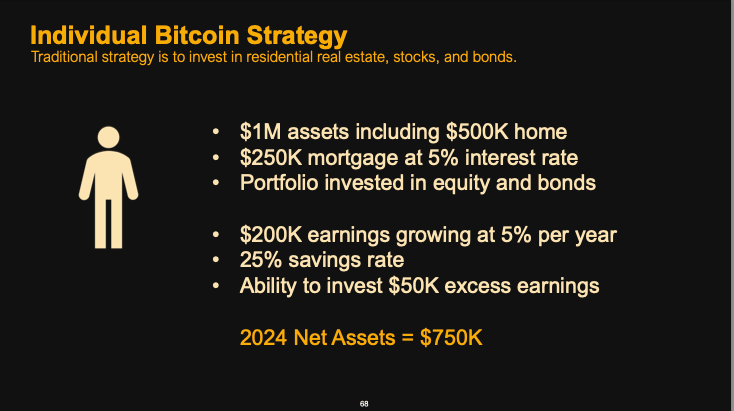

Consider a tech professional earning $200,000 annually with assets valued at $750,000. Assuming their earnings increase by 5% annually, they could strategically invest a portion of their savings in Bitcoin. This strategy might include taking out a personal line of credit on their mortgage, say $250,000, and investing it in Bitcoin. Additionally, they could convert stocks, bonds, and rental property holdings into Bitcoin, and consider relocating to a low-tax jurisdiction to reduce expenses and boost income.

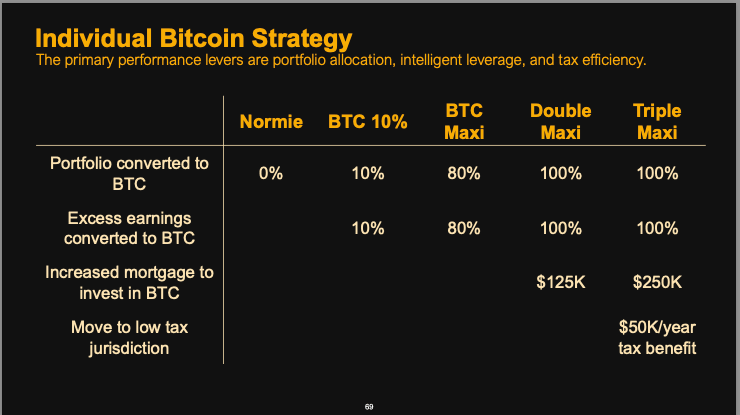

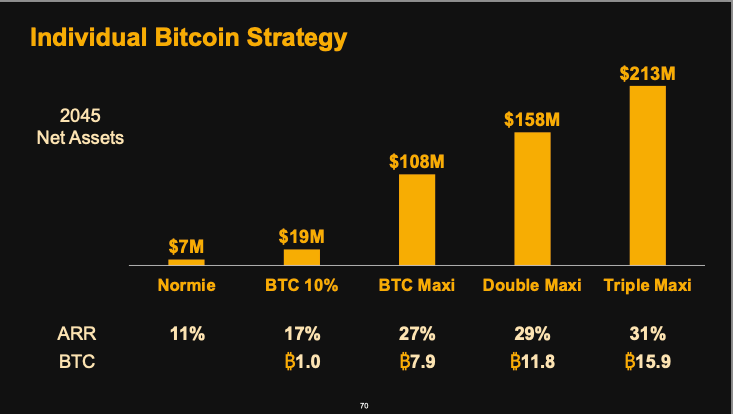

Michael Saylor outlines various approaches to Bitcoin investment:

- The Normie: Doesn’t invest in Bitcoin.

- BTC 10%: Allocates 10% of their portfolio to Bitcoin.

- BTC Maxi: Converts 80% of their portfolio and 80% of their savings into Bitcoin.

- Double Maxi: Puts 100% of their portfolio into Bitcoin, invests all excess savings in Bitcoin, and also increases their mortgage to invest in Bitcoin.

- Triple Maxi: Converts 100% of their portfolio into Bitcoin, puts all excess savings into Bitcoin, takes on maximum debt to invest in Bitcoin, and relocates to a low-tax jurisdiction to save money, further converting those savings into Bitcoin.

This spectrum highlights the varying levels of commitment and risk tolerance among Bitcoin investors.

If you’re a Normie, your portfolio is projected to be valued at $7 million by 2045. However, if you’re a Triple Maxi, your net worth could soar to $213 million by 2045.

Michael Saylor likens Bitcoin to Manhattan, describing it as a “cyber Manhattan” consisting of 21 million blocks, each representing a piece of digital real estate. He draws a parallel between 2009, when Bitcoin was created, and 1626, when the Dutch purchased Manhattan. Just as Manhattan has grown from a simple trade post into a bustling metropolis filled with skyscrapers and countless businesses by 2024, Bitcoin’s ecosystem is poised to flourish. Looking 400 years into the future, the potential for businesses and innovations built on Bitcoin’s blocks is immense. With AI likely to transact in Bitcoin, its value and significance will only continue to grow over time.

What is your Bitcoin Strategy?

I’ve fully embraced the Triple Maxi strategy by converting 100% of my portfolio into Bitcoin. Every bit of excess income goes straight into Bitcoin as well. Although I don’t own a house, I’ve maximized my debt to invest further in Bitcoin and MSTR. Additionally, I’ve relocated from a higher-tax to a lower-tax jurisdiction—not solely for Bitcoin investment, but the move has provided significant financial advantages, including optimizing my Bitcoin strategy.

It might be wise to consider getting some Bitcoin, just in case it catches on. When enough people adopt this mindset, it creates a self-fulfilling prophecy—driving demand, increasing its value, and solidifying its place in the financial landscape. This collective belief and action can turn a small investment into a significant opportunity as more people recognize and contribute to its growing momentum.

Conclusion

In conclusion, the journey of Bitcoin, from its inception to its adoption by individuals and institutions, reflects a profound shift in how we understand and manage value in the digital age. Michael Saylor’s insights and strategic decisions have highlighted the transformative potential of Bitcoin, not just as an asset, but as a foundational element of 21st-century finance. As the world continues to evolve, those who recognize and adapt to this new paradigm stand to gain significantly. Whether you are just beginning to explore Bitcoin or have fully committed to its potential, understanding its role in the future of global wealth is essential. The opportunities are vast, and the time to act is now.

Leave a comment