Breaking Free from Tradition

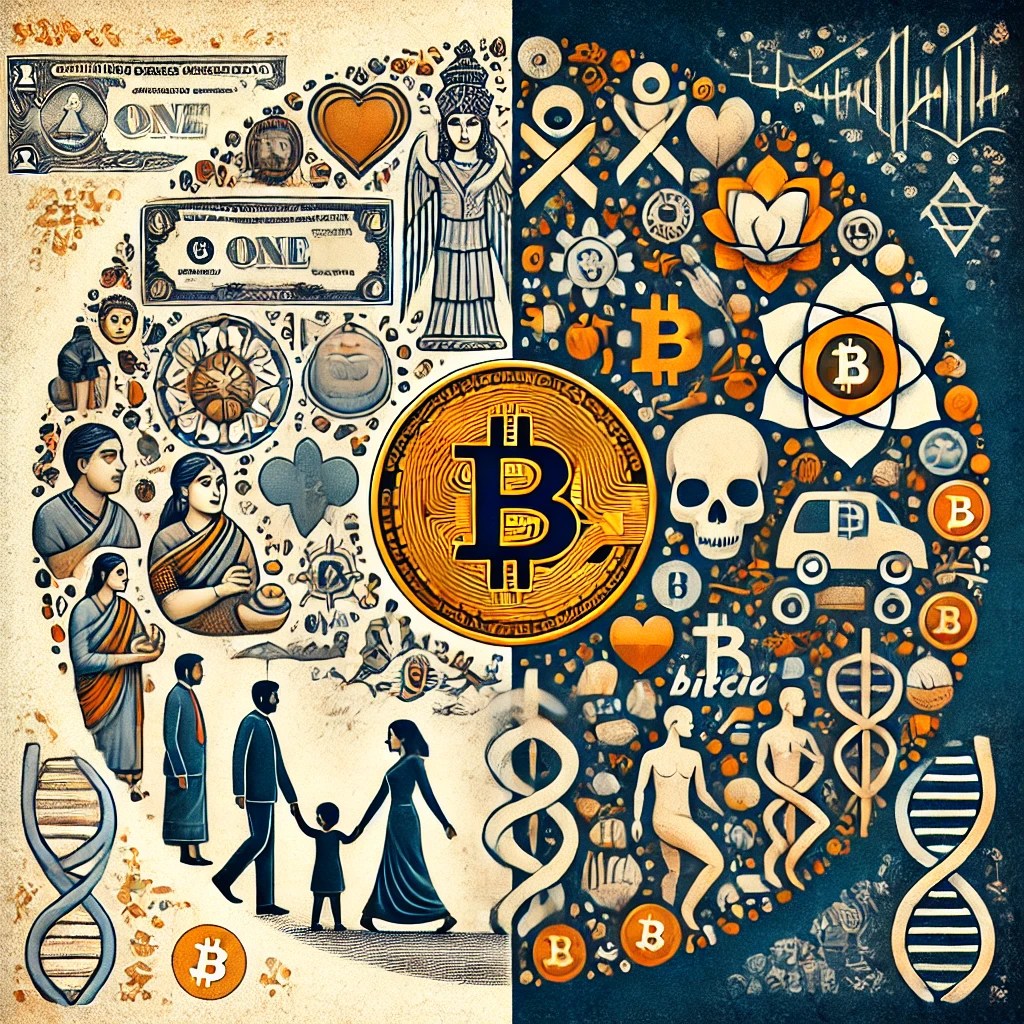

In today’s world, the USD is deeply entrenched as the global reserve currency. It symbolizes economic stability and global dominance, much like a family tradition passed down through generations. People have accepted it as the cornerstone of global finance, rarely questioning its place or its flaws. But what happens when a tradition outlives its purpose?

Just as outdated cultural norms get challenged over time, the USD hegemony is now being questioned by the rise of Bitcoin. This challenge to the status quo is unsettling for many. It feels like an attack on something sacred, something ingrained in our way of life. But change is inevitable, and Bitcoin represents that shift—a move away from centralized, government-controlled money to a decentralized, digital currency for the internet age.

My Journey with Ray Dalio’s Ideas

I’ve been a fan of Ray Dalio ever since I was introduced to him through Tony Robbins’ book, “Money: Master the Game.” This led me to dive deeper into Dalio’s works, including his insightful book Principles, which I thoroughly enjoyed. His analysis of life, economics, and leadership helped shape my thinking, and I was eagerly looking forward to his next big work: The Changing World Order, which he released in installments in 2020.

As I read Dalio’s arguments about the decline of the USD and the potential rise of China as the next global superpower, I couldn’t help but feel something was missing. While I understood the historical cycle he was describing, the idea that the world was shifting from analog to digital wasn’t addressed, nor was the potential for Bitcoin to play a significant role in this shift.

It was around this time that I stumbled upon Breedlove’s article, an open letter to Ray Dalio titled “An Open Letter to Ray Dalio Re: Bitcoin.” This article sparked a deeper curiosity in me about the future of money. Breedlove argued that Bitcoin was the next natural step in the evolution of global currencies, and that Dalio’s thesis was missing this crucial element. Reading this article was a turning point for me—I realized that while Dalio was focused on geopolitical power shifts, he wasn’t seeing the bigger picture of the digital revolution.

Bitcoin isn’t just a currency, it’s an entirely new paradigm. It’s decentralized, capped at 21 million coins, and immune to the manipulations of central banks. While Dalio saw the power shift moving from USD to Chinese Yuan, I began to see that Bitcoin could be the true successor—not tied to any nation, but to the decentralized, digital world.

The Fear of Letting Go: USD as a Family Tradition

Much like cultural traditions that feel sacred and unchangeable, the USD has been a symbol of stability for so long that people feel uncomfortable imagining a world without it. This emotional attachment mirrors the way people hold on to traditions in other aspects of life, such as arranged marriages in Indian culture.

For generations, arranged marriages have been the cornerstone of Indian family dynamics. But with the rise of dating apps, cross-cultural relationships, and a more globalized society, this tradition is being challenged. People are marrying across borders, religions, and castes, and this change is unsettling to those who cling to the old ways.

This fear of change also applies to the USD. People cling to the USD because it’s familiar and has been the bedrock of global finance. But just as cultural norms evolve, so too must our financial systems. Clinging to the past only delays the inevitable, and in both cases, this resistance to change comes with consequences.

Challenging Tradition: Bitcoin and the Decentralized Future

Bitcoin represents a break from the past. It challenges the centralized control of the USD and fiat currencies by offering a decentralized alternative. Bitcoin is capped at 21 million coins, ensuring scarcity—just like gold in the physical world. This makes it resistant to inflation, unlike fiat currencies that can be printed endlessly by governments.

But for many, embracing Bitcoin is terrifying because it requires breaking away from decades of financial conditioning. Just like questioning the long-held tradition of arranged marriages, adopting Bitcoin means letting go of the safety and comfort of the known, to embrace something new and uncertain.

The same fear that keeps people attached to traditional values also keeps them tied to fiat currencies. Yet, the more we cling to the past, the harder it is to recognize the opportunities that lie ahead. Bitcoin is a currency for the digital age, one that reflects the changing nature of our world. It’s not just a new financial system—it’s a fundamental shift in how we think about money.

Ray Dalio Misses the Big Picture

In Ray Dalio’s analysis, he rightly points out that the power of global currencies shifts with changes in global dominance. But what he fails to recognize is that the future is not about shifting power from one nation to another. It’s about shifting power from centralized institutions to decentralized networks.

Dalio is still thinking in terms of the physical world, where governments control economies and power is concentrated in the hands of a few. But Bitcoin represents a global, open protocol—a currency that isn’t tied to any one country, central bank, or political system. It’s the future of money because it reflects the decentralized, digital world we now live in.

The Pain of Change: Arranged Marriages and the Digital Shift

Change is painful for those who hold on to the old ways. Just as families who believe in arranged marriages feel discomfort with modern, cross-cultural unions, people who are invested in the fiat system feel threatened by Bitcoin. They fear that abandoning the old ways will lead to chaos.

But nothing stays the same. Just as Indian families are learning to adapt to changing marriage traditions, the global financial system must adapt to the changing nature of money. Bitcoin is the future, and it’s here to stay.

The Evolution of Health: Lessons from Tradition

There’s a similar shift happening in how we think about health, especially among men. In their 20s, men often view health as having big biceps and a six-pack. It’s a superficial, traditional mindset, focused on appearance rather than well-being. But by the time they hit their 30s, many realize that health is about good habits, having a body that’s full of energy, and avoiding preventable diseases.

This evolution of thought mirrors the way people are coming to understand money and finance. At first, we’re conditioned to focus on superficial aspects of wealth—how much we have, how it looks to others, how it’s tied to status symbols like the USD. But as we dig deeper, we realize that true wealth comes from financial freedom, from being untethered to systems that don’t serve us.

Just as health evolves from superficial goals to long-term sustainability, our understanding of money must evolve from chasing fiat to embracing Bitcoin as a tool for financial sovereignty.

Conclusion: Embracing Change

We live in a time where old traditions—whether they be about family, health, or finance—are being questioned and redefined. It’s uncomfortable, yes, but change is the only constant. The USD may have been the global reserve currency for decades, but its time is coming to an end. Bitcoin represents the future, a decentralized system for a digital world.

Those who cling to the past, who are emotionally invested in the USD or fiat currencies, will find the transition difficult. But those who embrace change—who recognize that the future of money lies in Bitcoin—will be better positioned for what lies ahead.

Just as traditions evolve in Indian culture and in how we think about health, our financial systems are evolving too. Ray Dalio’s analysis of currency shifts is insightful, but it misses the bigger picture: the future is digital, decentralized, and built on the foundation of Bitcoin. The question is, are we ready to embrace it?

Leave a comment